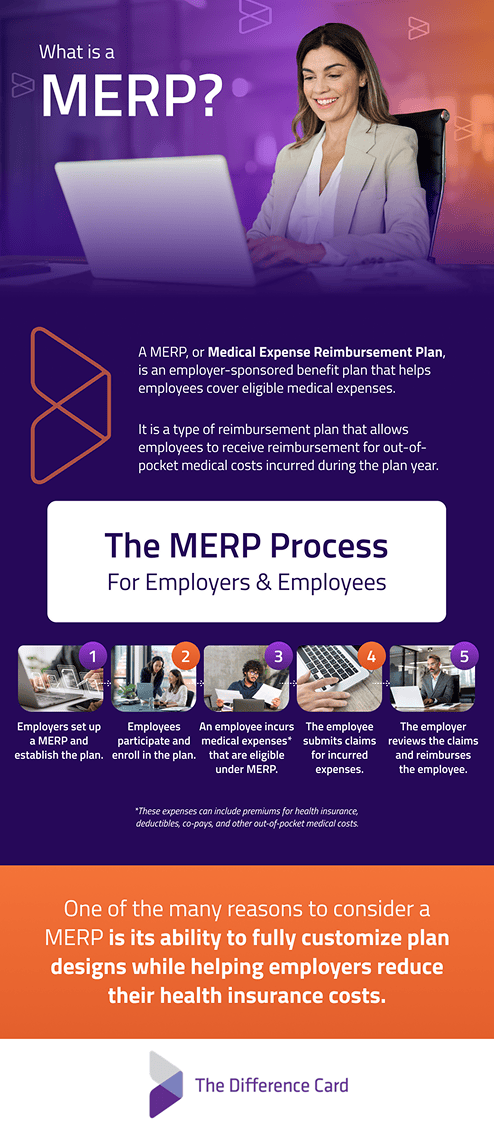

Employee Education – More Benefits at a Lower Cost

The Difference Card Account Executive Team will guide employer groups through every step of the process during implementation and open enrollment. Each Difference Card client gets a dedicated Account Executive along with virtual Open Enrollment Resources page that contains client specific benefit plans, a step-by-step video guide on how to use The Difference Card and any additional necessary educational materials.

When discussing MERPs with their employees, employers should focus on clear and transparent communication. It is essential to explain the purpose and benefits of the MERP, emphasizing how it helps employees manage their medical expenses effectively.

The Difference Card will provide comprehensive information about the eligibility criteria, reimbursement process, and available services. We will also highlight any flexibility and customization options that the MERP offers. Clear communication about contribution amounts, coverage limitations, and the role that The Difference Card plays is crucial.

Employers should encourage open dialogue, addressing any questions or concerns employees may have, and provide educational resources from The Difference Card to ensure employees understand how to maximize the benefits of the MERP.

By fostering open and informative discussions, employers can promote employee engagement, satisfaction, and utilization of the MERP to its full potential.