There is still time to make contributions to your or your employees’ 2021 Health Savings Account

Table of Contents

The deadline to contribute to an HSA for the 2021 Income Tax Year is April 18, 2022.

The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia – even if you don’t live in the District of Columbia.

Employees enrolled in an HSA with The Difference Card can contribute directly to their HSA account by using the The Difference Card Mobile App!

- 1. Click into your HSA account (make sure there is a bank account linked)

- 2. Click on 'Contributions'

- 3. Select 'Prior Year' as the contribution year

- 4. Indicate the amount you would like to deposit and press submit!

Employers can add prior year HSA contributions too!

Did you miss a contribution to an employee's HSA account in 2021?

No problem! You have until April 18, 2022, to make contributions for the 2021 tax year for your HSA-eligible employees. You can:

- 1. Use the Contribution Manager in the employer portal and select the option prior year for the HSA funds to be allocated to the 2021 tax year.

OR

- 2. Fill out the HSA Contribution form and select prior tax year.

Reversing prior year HSA contributions

Do you need to correct a contribution that you made to an employee's account in 2021?

No problem! You have until April 18, 2022 to reverse 2021 HSA contributions. Fill out this form here.

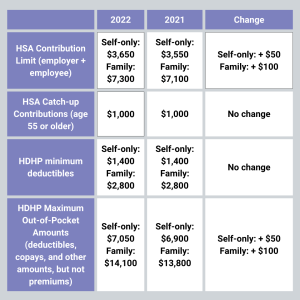

HSA Limits

Need a reminder on how to contribute to an HSA?

Read our latest blog post on "How to Contribute to an HSA."