What Is an HSA & How Does It Work?

Table of Contents

More Americans are starting to use Health Savings Accounts (HSAs) to assist with their healthcare costs. As HSAs gain popularity, you'll likely want to know if an HSA is right for you, especially if your employer offers an HSA in its benefits package with a Qualified High Deductible Health Plan (QHDHP). Fortunately, understanding a Health Savings Account is easy once you're aware of some basics about eligibility and how the plans work.

Learn more about what an HSA is, how it works and the main advantages and disadvantages of selecting one to help you decide if an HSA is a good idea for your health plan.

What Is an HSA?

A Health Savings Account is a type of personal savings account people can use to pay for medical expenses. Since these accounts are federally tax-free, account holders can use pre-tax dollars to pay for their medical costs. Eligible members can create and utilize these savings accounts by pairing them with high deductible health plans (HDHPs), as they can use their HSA funds for out-of-pocket medical expenses.

How Does an HSA Account Work?

When you have an HSA, you'll place tax-free contributions into the account throughout the life of the account. If you have a qualified medical expense, you can withdraw this money without incurring any federal taxes to pay for the expense. Since the money you put in is tax-deductible, an HSA account works to lower your taxable income, potentially saving you money when it's tax season. HSAs are the only investment vehicle with Triple Tax Savings!

When you open an HSA through an employer, you'll go through a process close to what you'd expect from a 401(k) plan. Many times, you'll be able to select from a variety of investment funds to create your desired HSA portfolio. Since this kind of HSA is available through an employer, the employer has the ability take contributions out of your paycheck for the HSA before paying you. Many employers also match a percentage of whatever contribution their employees pay into the HSA.

Since an HSA can take various forms, you can usually choose the percentage of your income you'll want the employer to take out of your paycheck. When you have an HSA through your employer, it's usually very convenient, as you won't have to spend time manually moving money to your HSA.

Going through an employer isn't the only option to receive an HSA. As an individual, you can work with a financial institution or a bank to open an HSA. Individual HSAs usually come with more funding options — but, of course, you won't receive any money from an employer via a match program. You'll also have to put money in your account rather than have your employer do it for you. You can take the deduction when you file your income taxes verses through pre-tax payroll contributions.

Whether you make contributions to your HSA through your employer or do so individually, your HSA provider will likely give you a medical debit card, like a Difference Card. This card will be connected to your HSA's balance.

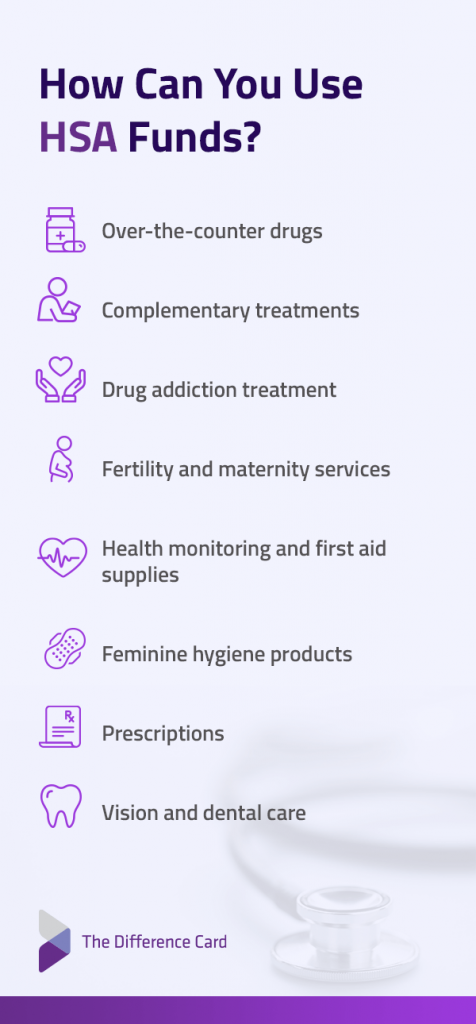

How Can You Use HSA Funds?

If you're interested in an HSA, you'll likely want to know how you can use your HSA funds. Fortunately, you can find plenty of eligible expenses that HSAs cover. You also don't have to just use HSA funds for yourself, as HSA funds can often be applied to the account holder's spouse or dependents.

What can you use HSA funds for? As you determine if an HSA is right for you, learn more about some of the most common medical expenses HSAs tend to cover:

- Over-the-counter medications: You can purchase many over-the-counter drugs, such as pain relievers, allergy medicine and cold medicine, sunscreen, PPE and more with your HSA.

- Complementary treatments: Many HSAs cover complementary treatments meant to assist with wellness, such as massages or chiropractic care.

- Drug addiction treatment: If you need assistance with addiction recovery, you can often use your HSA balance to pay for the costs associated with it, such as inpatient treatment expenses.

- Fertility and maternity services: You can find HSA's covering various maternity services, such as breast milk storage bags and breast pumps. They also tend to cover fertility enhancement expenses, such as those for in vitro fertilization or surgery.

- Health monitoring and first aid supplies: Many health monitoring and first aid supplies are usually covered by your HSA, such as compression socks, glucometers, bandages and pressure cuffs.

- Feminine hygiene products: You can pay for pads, tampons and other feminine hygiene products with your HSA balance.

- Prescriptions: An HSA often covers insulin and prescription drugs.

- Vision care and dental care: While not always covered by insurance plans, a Health Savings Account Holder can often pay dental care with their HSA balance. They can also use their HSA to pay for some vision expenses, such as lost or damaged contact lenses and even eye surgery.

Who is Eligible for an HSA?

HSAs are overseen by the federal government, with the government creating and enforcing various guidelines about who's eligible. One of the most significant requirements for HSA eligibility is that your current health insurance is a Qualified High Deductible Health Plan (QHDHP).

An HDHP is a health plan that has relatively high deductibles with relatively low premiums. Someone who wants to have an HSA must have a QUALIFIED High Deductible Health Plan that meets the federal government's guidelines for the maximum out-of-pocket threshold and minimum deductible for the year for an HSA.

For 2021, the IRS sets the minimum annual deductible at $1,400 for self-only coverage and $2,800 for family coverage. The IRS also has set the maximum annual deductible and other out-of-pocket expenses at $7,000 for self-only coverage and $14,000 for family coverage. If you've enrolled in an HDHP meeting these IRS requirements, you're often eligible to enroll in an HSA.

Though being enrolled in a QHDHP is one of the biggest factors in someone's HSA eligibility, other variables matter, too:

- You must not be claimed as a dependent.

- You must not be enrolled in Medicare.

- You must not be covered by other health plans other than your QHDHP, such as a spouse's health plan.

- You must not be using military benefits from the Veterans Administration.

- You must not be part of other disqualifying alternative medical savings accounts, such as a Health Reimbursement Account (HRA) or a Flexible Spending Account (FSA).

- You can, however, contribute to a Limited Purpose FSA (LPFSA).

- You must not be enrolled in TRICARE for Life or TRICARE.

Frequently Asked HSA Eligibility Questions

If you're interested in an HSA, you might still have a few questions about your eligibility. Take a moment to review some answers to frequently asked HSA eligibility questions:

- Do you have to be an employee? You don't have to go through your employer to be eligible for your HSA.

- Can you set up your own HSA? Since you don't have to be an employee to have an HSA, you can set up the HSA on your own without an employer's help. These HSA accounts typically come with some restrictions, but you can set them up by yourself.

- Are there any income limits? An HSA doesn't have any income limits.

- Can you open an HSA for your children? HSAs are restricted to adults, so it's impossible to set up standalone HSAs for your children if you can claim them as dependents.

- Can your spouse set up an HSA? Unlike children, spouses can also have an HSA if they meet other qualifying HSA eligibility requirements.

- Do you have to be employed to contribute to an HSA? You don't have to be employed to contribute to an HSA. You can put funds in that come from other sources, such as unemployment, personal savings and dividends income.

If you're interested in an HSA, you might still have a few questions about your eligibility. Take a moment to review some answers to frequently asked HSA eligibility questions:

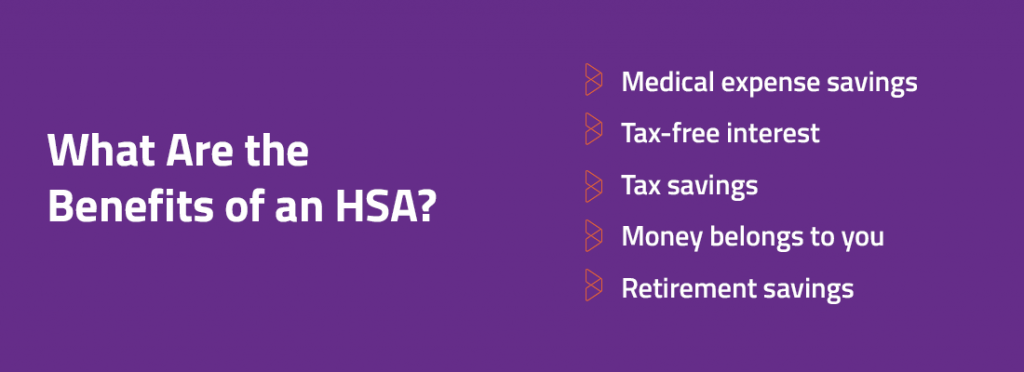

What Are the Benefits of an HSA?

HSAs come with several benefits that make them a popular option for those with HDHPs. Some of these advantages include the ability to earn interest, save for retirement and keep the money you put into it. Find out more about the many benefits of an HSA below:

- Medical expense savings: With an HSA, you can see medical expense savings. Instead of paying for medical expenses with taxable income, you can use the tax-free money in your HSA to pay for health care expenses like your deductible, coinsurance and copays. You can also use the money to pay for things health insurance usually doesn't cover, such as eyeglasses, orthodontia, contacts and dental care. By paying for these expenses with tax-free income, you can save money on your medical costs in the long run.

- Tax-free interest: When you have an HSA, the money in your account will earn tax-free interest. As your money grows, you can use it for your future health care needs or retirement. When you meet specific criteria, you can even place part of your HSA balance in bonds, mutual funds and stocks.

- Tax savings: Since HSA contributions are deposited into your account before taxes, they can lower your taxable income. By lowering your taxable income, you can end up paying less in taxes, making HSAs an attractive option with tax advantages.

- Money belongs to you: Unlike other medical spending plans like FSAs, LPFAs, and DCAs, the money you place into an HSA account is yours. You can choose how and when to spend it or if you want to save it. If you initially received an HSA via an employer, you can take the HSA with you when you change jobs. You can also keep your money if you purchase a different HDHP.

- Retirement savings: The money you put into an HSA will never expire. Due to these savings, you can use any money you have in your HSA for retirement. Once you turn 65, you can use your HSA funds for whatever you want without any penalties.

Are There Any Drawbacks to an HSA?

While there are many benefits to HSAs, you should be aware of a few drawbacks before opening an HSA. Some of these drawbacks include:

- Restrictive access: Since you can only contribute to an HSA if you have a QHDHP, it's limited to a select group of people.

- Limited ways to spend: You can't use your HSA funds for anything except eligible medical expenses, deductibles and copays until you pass 65. These limitations can be unattractive to some who want to use their money more freely.

- Taxed for any non-medical expenses: When you withdraw money from your HSA for non-medical expenses, it'll be taxed. This money may even be subject to federal government penalties.

- Must maintain a record of expenses: At times, HSA account holders may be the subject of an IRS audit. Due to the potential for an audit, you'll have to track your expenses and retain a record of them.

While there are many benefits to HSAs, you should be aware of a few drawbacks before opening an HSA. Some of these drawbacks include:

Due to some of the drawbacks of an HSA, you might be interested in alternatives, such as a Difference Card FSA or Difference Card HRA if offered by your employer.

FSAs are typically offered by an employer and don't have any requirements, meaning someone without an HDHP can still create one. Like HSAs, FSAs allow account holders to deposit money into them and spend on qualified medical expenses without this money being taxed. However, with FSAs, carryover options are typically limited.

HRAs are another popular option, with these accounts set up by employers and designed to completely fund their employees' copays, deductible expenses, coinsurance and out-of-pocket expenses an employee might have with their insurance. Unlike HSAs, HRAs are entirely funded by an employer, so if an employee moves jobs, they won't be able to take their HRA coverage with them.

How to Open an HSA With Your Employer

If you're interested in an HSA and your employer offers one, it's usually easy to open an account. An employer will typically give you all the information you need about the HSA and the steps to properly open an HSA in your name. Generally, an employer's HR department will assist an employee as they set up an HSA.

Before you open an HSA, it's important to first check eligibility requirements and other qualifications to ensure you meet them. You can also review the particular terms of the HSA to see what you can spend the money on and other rules that may apply to you. Since your employer may offer multiple HSA options, it's a good idea to review these options to find the right fit for your needs.

Learn About HSAs From Difference Card

The Difference Card is a health insurance solution designed to help you get more out of your underlying medical plan. We regularly assist our members by reducing their out-of-pocket spending, increasing their overall wellness and providing personalized support. One of our popular solutions is our Difference Card HSA, which features a Triple Tax Advantage. This advantage means any money you contribute, the interest you make from your balance and the money you use for qualified distributions are tax-free.

Our Difference Card HSA also comes with the benefit of quick access to your balance. For example, as soon as you contribute to your HSA, you can swipe your Difference Card and instantly use the new funds.

Review our Difference Card HSA offering today. If you have any questions, please feel free to contact us for a custom proposal, and one of our team members will be happy to help.