How Does The Difference Card Work?

Table of Contents

- What Is The Difference Card?

- Who Is The Difference Card For?

- How Does The Difference Card Work?

- How Does The Difference Card Save Money?

- How Does The Difference Card Deliver Better Benefits for Less Money?

- Why Should Businesses Choose The Difference Card?

- What Is The Difference Guarantee?

- The Difference Card FAQs

- See the Difference With The Difference Card

As healthcare costs continue to rise, employers, employees, and healthcare insurance brokers are continually seeking the best healthcare benefits solutions. In every case, this means a healthcare plan that's cost-effective and provides the necessary coverage for employees.

The Difference Card already provides that solution to many businesses, and is ready to help even more employers, employees, and brokers. With The Difference Card, employers consistently save money while their employees enjoy excellent health benefits. Exactly how we do this varies from one business to the next.

So, how does The Difference Card work, and what exactly is it?

What Is The Difference Card?

The Difference Card is an employer-sponsored benefit that supplements a health insurance plan. If an insurance plan doesn't cover a certain medical expense, The Difference Card will reimburse employees for costs the benefit plan covers. It might also cover the cost of insurance premiums and deductibles.

Exactly what expenses The Difference Card covers depends on the plan structure, which the employer chooses based on their budget, business needs, and employees' needs.

The Difference Card is designed to help employers, employees, and insurance brokers at a time when affordable and comprehensive medical plans have become increasingly scarce.

Who Is The Difference Card For?

Expensive and ineffective medical coverage can have wide-ranging effects on the country. While The Difference Card's solutions can't fix all of these problems, it is designed to benefit various groups:

- Employers looking for the perfect healthcare plan for their employees.

- Employees who need a healthcare plan.

- Health insurance brokers searching for the best solution for their clients.

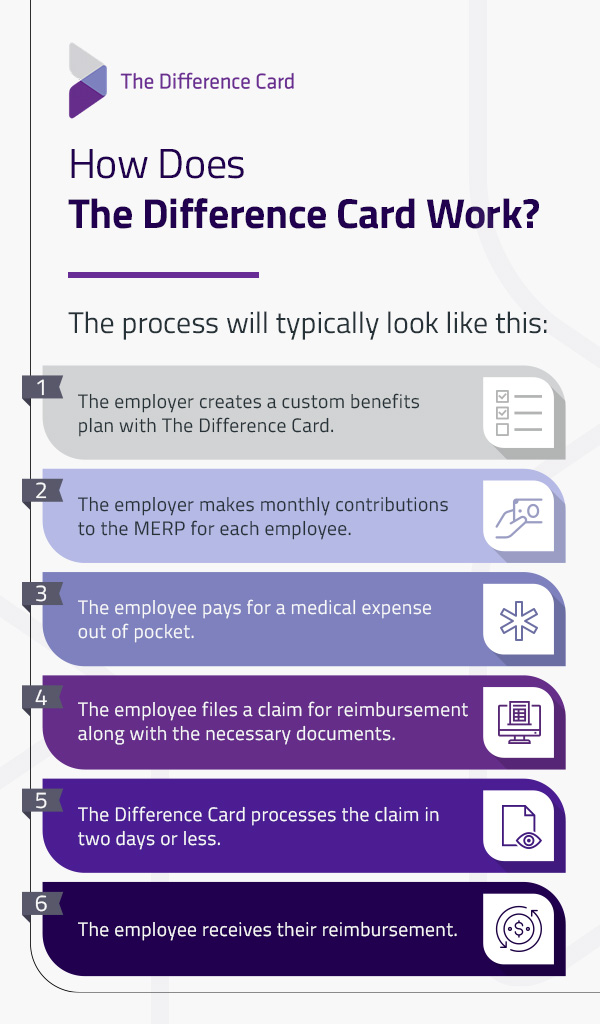

How Does The Difference Card Work?

The Difference Card works as a medical expense reimbursement program (MERP). Designed to be flexible and cost-effective, a MERP product can cover various medical expenses, from doctor visits and hospital appointments to surgeries and prescription medications.

The process will typically look like this:

- The employer creates a custom benefits plan with The Difference Card and decides which expenses are covered.

- The employer makes monthly contributions to the MERP for each employee.

- The employee pays for a medical expense out of pocket.

- The employee files a claim for reimbursement along with the necessary documents.

- The Difference Card processes the claim in two days or less.

- The employee receives their reimbursement.

For some plans, the process is even easier. If they wish, the employer can provide each employee with a debit card, which they can use to pay for certain medical expenses, such as copays. This removes the need for employees to front the cost of the expense themselves.

How Does The Difference Card Save Money?

Our clients have saved an average of 18% on their yearly insurance costs since 2001. The Difference Card offers employers tax savings, additional cost-control measures, and a healthcare plan that covers exactly what's needed. Together, these benefits enable employers to reduce their health insurance costs across the board.

Employees also save money with The Difference Card. When medical insurance doesn't cover an expense, it's usually up to employees to cover the cost. With The Difference Card, the MERP covers that expense for them, saving them money on their medical expenses.

How Does The Difference Card Deliver Better Benefits for Less Money?

When someone tells you that you'll get more benefits by spending less money, it's natural to be skeptical. At The Difference Card, we're fully transparent with how we operate and deliver great healthcare plans at lower prices.

We partner with many highly rated insurance companies, which offer medical insurance plans to complement our MERP. Thanks to this variety of choice, we can find the insurance plan that best suits the business and its team.

We also help employers find the optimal balance between insurance coverage and their MERP to ensure their employees receive the coverage they need at the best possible price.

Finally, any unused funds from the plan year revert to the employer, allowing them to repurpose this money for the following year's contributions.

Why Should Businesses Choose The Difference Card?

With over two decades of experience, The Difference Card understands how to deliver the best possible healthcare plans for employers and employees alike. Further, we don't stop going the extra mile once we've helped our clients find the perfect plan — our clients regularly highlight our excellent customer service.

All of this means we can reliably deliver these benefits:

Employer Benefits

Beyond decreased costs, The Difference Card can provide many other benefits for employers. Chief among these benefits is the increased employee satisfaction within their team. Knowing that their employer's contributions cover many of their healthcare expenses creates a positive atmosphere within the workplace. Moreover, these benefits can lead to both higher retention rates and increased hiring power.

Compliance is an issue that many businesses must address, but The Difference Card also helps in this regard. A MERP must meet several standards to protect employers and employees. The Difference Card ensures every aspect of the plan is fully compliant, so employers have nothing to worry about.

The Difference Card gives you all the information you could want about your MERP's performance, too. From how much money it's saved you to how your employees use it, you'll have all the data you need at your fingertips. With this information, you can make informed decisions about your plan, periodically adjusting it to best suit the business and your employees.

Employee Benefits

Employees have plenty of reasons to celebrate when they have a MERP provided by The Difference Card. Among the most important reasons is that employees can enjoy medical coverage that's specifically designed to meet their needs, all at a time when their employer was forced to cut costs. And since MERP products are employer-sponsored, employees won't have to contribute to the plan with their own money, unlike with many other healthcare products.

While employees are typically reimbursed for a medical expense they've already paid, this is not always the case with The Difference Card. If the employee prefers, they can submit an explanation of benefits from the insurance provider and request that we pay the medical expense directly. With some Difference Card benefits, the employee may initially have to pay a portion of the expense themselves, but with other plans, they won't have to worry about this.

When the employee does require reimbursement, they won't have to wait long. Thanks to our streamlined process and dedicated team, we process 99% of claims within two business days, ensuring employees receive their reimbursements promptly without unnecessary delays.

All of this provides invaluable peace of mind for employees who may otherwise have worried about rising healthcare costs.

Digital Tool and Resources

The Difference Card also provides digital tools that make the product easy for both employers and employees to use. Our employer resources provide everything employers need to get started with The Difference Card, while our member resources make it easy for employees to enjoy their benefits.

Members can use our mobile app to access their Difference Card account from anywhere. The app can also provide personalized recommendations on how members can find the best healthcare options for them.

Healthcare insurance brokers can find various producer resources that make it easy to work with The Difference Card and offer it as a solution to your clients.

Why Should Insurance Brokers Choose The Difference Card?

We know that The Difference Card has much to offer employers and employees that many other providers can't. That's why we believe any health insurance broker can help their clients by working with The Difference Card.

We partner with best-in-class brokerage agencies and independent agencies, helping them to grow their businesses and provide the best solutions for their clients.

In 2024, our producer partners generated $168 million in new medical premiums, all while helping their clients save money and enjoy a health plan tailored to their specific needs.

What Is The Difference Guarantee?

It's easy for providers to promise the world and claim that their customers will save money with them, but without a guarantee, this promise can easily fall through. That's why we created The Difference Guarantee.

When you choose The Difference Card as your provider, we guarantee that your healthcare expenses won't exceed a certain dollar amount. If it does, we'll cover the excess amount and send you a check for the amount you paid above the guaranteed amount.

The Difference Card FAQs

It's always good to ask questions about your health plan — it's how you ensure you choose the right one for you. Here are some of the most commonly asked questions about The Difference Card.

What Is the Onboarding Process With The Difference Card?

We take care of our clients from the moment they reach out to us, which is why we place a high value on creating a seamless onboarding process. During onboarding, your dedicated account manager will:

- Ensure you have all the support you need as you implement The Difference Card into your business.

- Provide educational materials and communications to clearly explain The Difference Card to employers and employees.

- Assist with open enrollment education sessions for employees.

And if you need any advice or guidance at any point during the onboarding process or after, you can receive support from us 24/7, 365 days a year.

How Does The Difference Card Ensure Compliance?

To avoid expensive financial penalties, businesses must be fully compliant when they provide a healthcare plan to their employees. Exactly what compliance means for each employer depends on their plan and their business.

We provide extensive compliance support to all our administrative clients, including plan documents, amendments, restatements, and non-discrimination testing. Coupled with expert advice, we help make sure that businesses are fully compliant with the necessary standards.

How Does The Difference Card Differ From Traditional Health Insurance?

There are several differences between The Difference Card and traditional health insurance.

- Expense payment: Traditional health insurance typically covers the cost of medical expenses, while The Difference Card reimburses the member at a later date.

- Employee costs: The Difference Card is fully employer-sponsored, whereas traditional health insurance costs might be shared with the employee.

- Claims process: Employees must submit claims to traditional insurance providers directly, but make claims through The Difference Card's third-party administrator.

- Business costs: The Difference Card helps businesses save on their healthcare benefits' costs while still providing health insurance.

However, it's important to remember that The Difference Card delivers the best cover when paired with health insurance, rather than instead of it.

How Customizable Is The Difference Card?

One of the best parts of The Difference Card is how customizable it is. Employers can decide which benefits they want to cover through healthcare insurance and which will be covered by the MERP, giving them the freedom to lower their insurance costs.

For example, an insurance plan may have a $50 copay for a doctor's visit. An employer could choose to cover $25 with their MERP, and the employee would only pay $25 out of pocket.

How Do You Read The Difference Card Summary of Benefits?

When an employee is enrolled in The Difference Card, they'll receive a Summary of Benefits. This document describes what benefits the employer has provided and how much The Difference Card will pay toward each of those expenses. Generally, employees must meet their deductible and coinsurance expenses before The Difference Card will reimburse them.

You can read your Summary of Benefits as:

- Column 1: The first column will describe the type of benefit you receive.

- Column 2: The second column will detail how much you pay toward that expense, if anything.

- Column 3: The third column will detail how much The Difference Card will pay toward that expense.

- Column 4: The fourth column will detail how much your insurance will pay toward that expense.

What Expenses Are Usually Covered by The Difference Card?

Since The Difference Card allows employers to customize their plan, there's no guarantee that what's covered in one plan will be covered in another. However, some expenses that are most commonly covered include:

- Doctor appointments.

- Prescription medication.

- Surgeries and hospital care.

- Health insurance premiums.

See the Difference With The Difference Card

Whether you're an employer struggling to keep costs down, an employee worried about paying for their healthcare, or a health insurance broker whose clients are in despair, rising health costs are likely causing you some sleepless nights. That's why The Difference Card is here to help all of our partners and members see the difference when they choose us as a valued healthcare benefits provider.

To find out more about how The Difference Card can help you, get in touch with us today.